How it works

Your PDF Document

Print, and Share

It Legally Binding

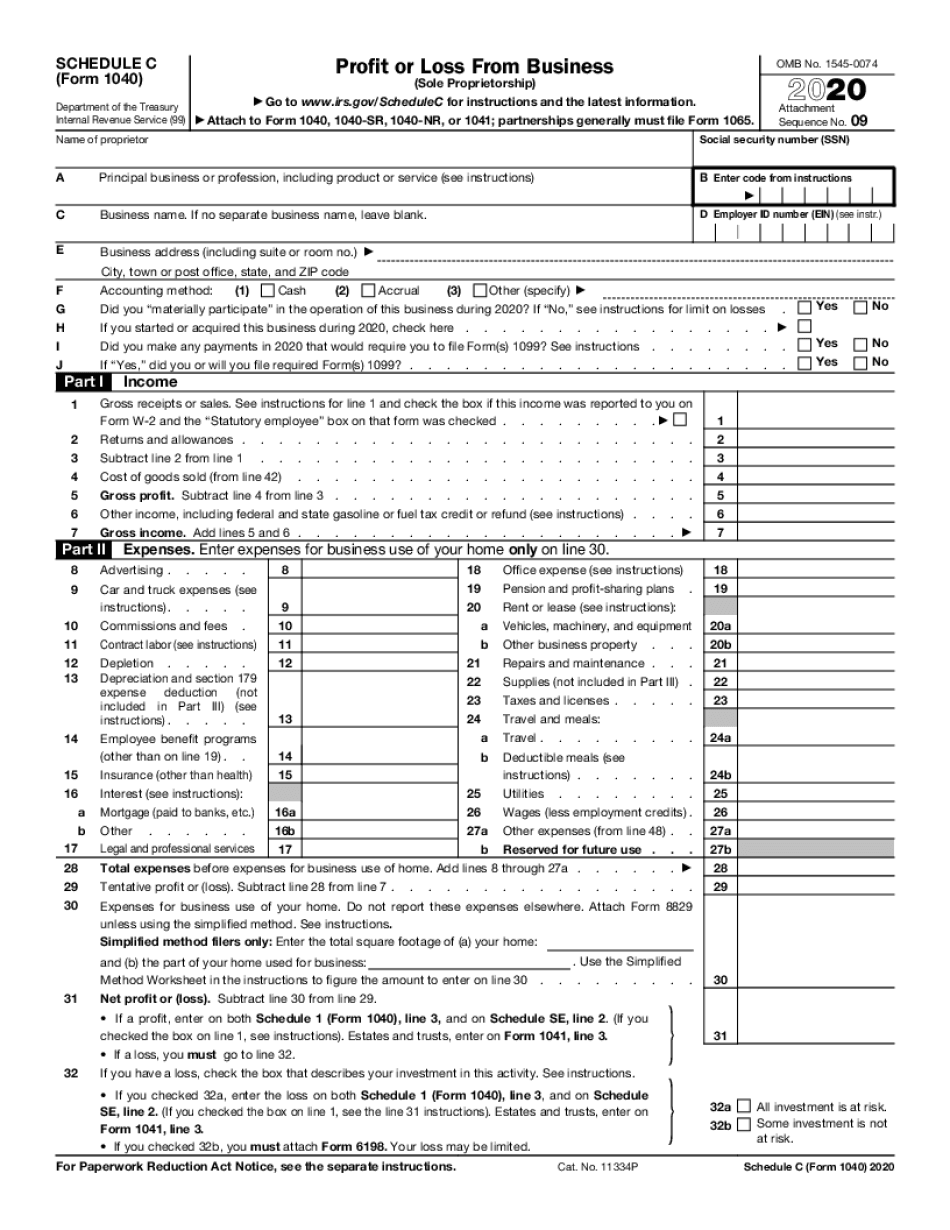

What is Schedule C 1040 Form?

Schedule C is part of Form 1040. It's used by sole proprietors to let the IRS know how much their business made or lost in the last year. The IRS uses the information in Schedule C to calculate how much taxable profit you made 14and assess any taxes or refunds owing.

How to start PDF Editing for Schedule C 1040 Form

To work on your PDF, you need to find a decent PDF Editing for Schedule C 1040 Form. Our web-based service helps you to simplify the editing process providing you with an array of professional tools. You can explore the entire suite in no time using an intuitive interface. The solution saves you time and effort and delights you with a high-level user experience. To start PDF Editing for Schedule C 1040 Form, use the step-by-step guidelines below:

Our tool is the fastest and easiest way to cope with red tape. Plus, the solution is safe and processes your data according to industry-standard security, complying with GDPR, ESIGN, and so on. Feel confident knowing that your information is under protection. Try out the service now and get the most out of it to establish a flexible and robust workflow.

Benefits of trying our PDF Editing for Schedule C 1040 Form

Looking for necessary tools can take hours. Plus, you have no guarantee that you will find a service that suits your needs. Try our PDF Editing for Schedule C 1040 Form, and you don't waste your time. The solution helps you complete and improve your documents in minutes providing you with professional editing tools. So that you forget about scanning and printing documents forever. This is the very first but important step towards paperless document management. Here are five reasons why you should give the solution a shot:

How To Guide

How to start PDF Editing for Schedule C 1040 Form

To work on your PDF, you need to find a decent PDF Editing for Schedule C 1040 Form. Our web-based service helps you t